TERP Explained—This Texas legislative session, a bill was filed in the Senate that challenges the role of ethanol in state-owned vehicles. The bill seeks to achieve this by modifying the Texas Emissions Reduction Program, known as TERP. As TGSA pushes back on this attempt to hinder the state’s ethanol industry, we thought it would be valuable to explain what TERP is and how it operates.

TERP was founded by the Texas Legislature in 2001 with the intent of establishing programs to provide financial incentives towards reducing polluting emissions from vehicles and equipment. TERP is contained within the Texas Commission on Environmental Quality and derives its funding from a variety of sources:

- Contributions from firms in nonattainment areas (meaning areas that fail to meet federal Clean Air Act standards)

- Surcharges on equipment rentals and purchases

- Surcharges on large-sized diesel vehicle rentals and purchases

- Fees on car title purchases

- Surcharges on truck-tractor rentals and purchases

- Vehicle inspection fees

- Recapture on provided grants

These funds are dedicated to a wide range of programs designed to improve air quality in nonattainment areas by targeting the reduction of nitrogen oxide, particulate matter, or volatile organic compounds. For example, one of TERP’s first major forays was to provide grant money to offset the costs of retrofitting diesels to reduce emissions. Other projects that qualify for TERP assistance include, but are not limited to:

- Clean school bus programs

- Regional air monitoring systems

- Drayage truck incentive program

- Clean fleet program

- Alternative fueling stations

TERP also provides financial assistance for entities that purchase vehicles that are compatible with alternative fuels (biodiesel, natural gas, electricity, and – most pertinent to sorghum producers – ethanol). This has, in part, encouraged the state to predominately purchase ethanol-compatible vehicles and has helped grow the demand for ethanol in nonattainment areas. The legislation introduced this session that challenges ethanol’s role in reducing emissions seeks to do so by mandating that all qualifying state agencies replace their fleet with vehicles that use any kind of alternative fuel that is not ethanol. This “mandatory replacement” section is contained in a larger bill that broadly restructures the funding mechanisms for TERP. The alternative fuels section of TERP was up for review in 2017 regardless, but the mandatory nature of the replacement and the singling out of ethanol are cause for concern across the agriculture industry. TGSA will continue to keep you up-to-date on how you can help preserve the ethanol industry and push for better environmental policies.

Inzen Sorghum Update—Currently, it looks like the earliest Pioneer or Advanta will have Inzen sorghum seed commercially available will be 2019, and it is possible that it could be 2020. Dupont Crop Protection will be testing the technology with universities again in 2017. Most of the seed used in these trials will be provided by Advanta, but there will be a limited supply of Pioneer seed for use in Texas, Kansas, Oklahoma and Nebraska. There are two Advanta hybrids that will be used in these trials. Both are different from the hybrid used in 2016 trials. There are three Pioneer hybrids that will be tested depending on the location, with many more hybrids in the pipeline to be tested in future years. It is anticipated that it will still be several months before Canada gives plant novel trait (PNT) approval for Inzen sorghum. For this reason, any grain harvested MUST NOT be allowed into the grain export market. Similar to last year, Dupont will be giving investigators instructions on what to do with any harvested grain.

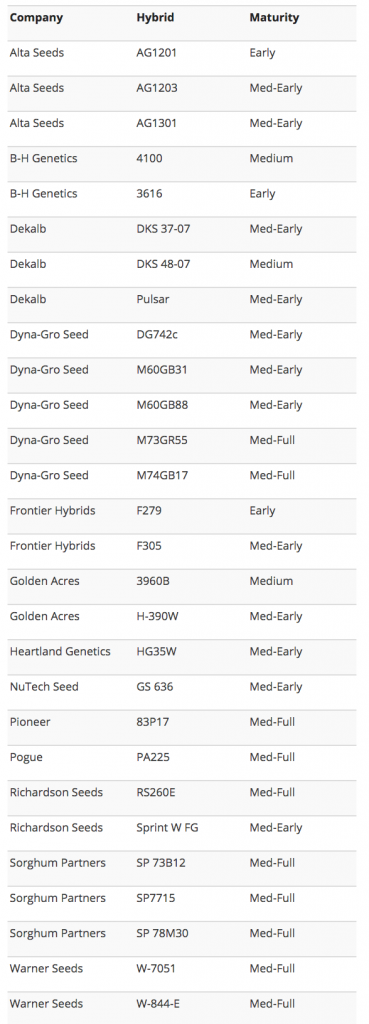

SCA Management Tips— The table below lists those sorghum hybrids that have been identified over the last two years that have tolerance to sugarcane aphid based on university and other independent trials. All of the hybrids listed are being marketed by their respective seed companies as sugarcane aphid tolerant. This is not a complete list and companies may be promoting additional hybrids as sugarcane aphid tolerant. Only those hybrids that have been identified as tolerant by a third party have been included here. Click here to see the entire list on USCP’s website. Research has shown that sugarcane aphids reproduce slower on tolerant hybrids and in some cases are able to withstand a higher sugarcane aphid population without a reduction in yield compared to susceptible hybrids. Tolerant hybrids have been shown to delay when sugarcane aphids may reach the economic threshold. Growers, however, should scout and apply and insecticide to tolerant hybrids if and when the economic threshold is reached. In some cases multiple applications of insecticide may be necessary. The Sorghum Checkoff also recently released eight videos on SCA management. The video series discusses topics such as sugarcane aphid biology, tolerant versus susceptible hybrids, insecticide rates and applications, control with other pests, late season control, integrated pest management and pre-planting decisions. Click here to watch any of the informational videos.

Filing Open Space or Agricultural Use Valuation Application—The deadline for filing open space, ag use, and wildlife management valuation applications is May 1. The Chief Appraiser may, for good cause, extend this deadline by up to 60 days, but obviously the more prudent route is to be sure and file applications by the May 1 deadline. [For more background on the differences between and requirements for open space, agricultural use, and wildlife management use valuation, click here.] This applies to landowners in several situations. First, if your property is qualified under “agricultural use” rather than “open space,” a yearly application must be filed by May 1. (Most land in TX now qualifies under the “open space” standard rather than the traditional “ag use” standard.) Second, if a landowner wishes to have his property qualified for open space valuation and it has not previously been considered as such, the one-time application must be filed by May 1. Third, if a landowner wishes to change the land from open space use to wildlife management use, he or she must notify the Chief appraiser of this desired change by May 1. Finally, a landowner who purchased property in the last year that previously had the open space valuation exemption is required to file a new application by May 1. For example, say Bill purchased ranch land in Texas in August 2016. The land has been used for cattle ranching for decades and has always been valued as open space land for property tax purposes since the prior owners filed their application years ago. If Bill wants to continue to have his taxes determined based upon the open space valuation approach, Bill will have to file an application with his County Appraisal District by May 1 this year. If he fails to do so, he will likely not receive the open space valuation appraisal and, instead, will pay taxes based on the fair market value of his land. This will almost always result in a significant tax increase. Recently, Braun & Gresham law firm published a great list of questions to ask when purchasing land in Texas. This story first ran in Texas Ag Law

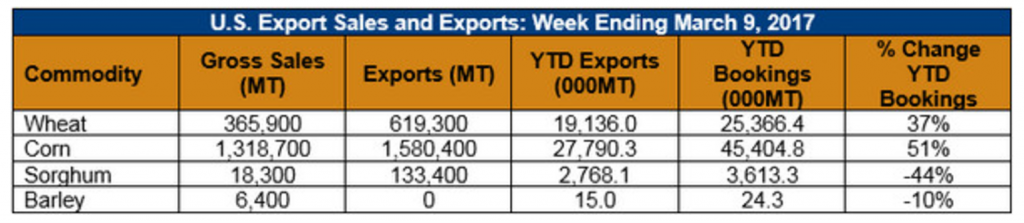

Market Perspectives— Sorghum: Net sales of 16,000 MT for 2016/2017 were down 86 percent from the previous week and 82 percent from the prior 4-week average. Increases were for China (53,300 MT, including 51,300 MT switched from unknown destinations), Japan (13,300 MT, including 3,000 MT switched from unknown destinations and decreases of 900 MT), and Mexico (5,100 MT). Reductions were reported for unknown destinations (55,700 MT). Exports of 133,400 MT were up noticeably from the previous week and up 10 percent from the prior 4-week average. The destinations were China (103,300 MT), Japan (28,400 MT), and Mexico (1,700 MT).